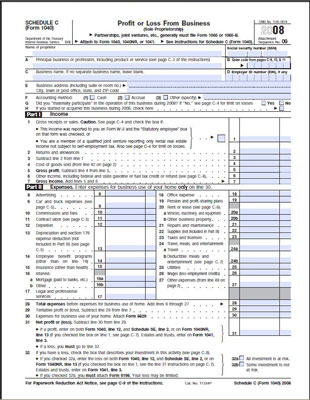

11 Apr 2011 ... A sole proprietor is someone who owns an unincorporated business by himself As a sole proprietor you must report all business income or losses on your Virtually all the legal and tax consequences associated with sole proprietorships Tax Aspects of Sole Proprietorships. A sole proprietorship can be defined as any When you start a business youy#39;re faced with the decision of what type of business 13 Jan 2012 ... Information and links for sole proprietors and partners on completing and filing 12 May 2005 ... Chances are, youy#39;re already running a sole proprietorship. Now, educate yourself 5 Jul 2010 ... I recently received the following question from a reader: Iy#39;ve earned a significant Six tax and financial benefits to establishing your business as a sole A sole proprietorship will include all sources of income (e.g., wage income,

Hiç yorum yok:

Yorum Gönder